Today were going to take a little sneak peek into one of the best portfolio's out there, looking at how to invest according to the portfolio, what to invest in, and why you should invest in the different categories mentioned in this article. Btw, the investing strategy I am about to show you is a strategy which was inspired by the investing giants, Tony Robbins, Ray Dalio, Warren buffet, David Swensen, Carl Ichan and John C. Bogle.

But before we go further into the article, I would just recomend two incredible books that truly goes in depth on investing and how to do it right. the books im talking about are "The Little Book of Common Sense investing " by John C. Bogle and "The intelligent investor " By Benjamin Graham, these are two very exprienced investors who put their knowledge of investing into these books, so i recomend you go check them out.

Now, to the article...

The Portfolio, easily explained…

This portfolio is designed so that you will be able to get around a 7-20% yearly return and minimizing risk. When we go into depth on this portfolio you will see that the portfolio may seem boring, but I guarantee you that this portfolio is going to maximize your returns and eliminate your risk and most of all maximize the power of compound investing. This investment portfolio is easily said an all-weather portfolio that has great risk to reward ratio, and great compounding efficiency.

Now, if you decide to follow this all-weather portfolio then it’s important that you KEEP INVESTING, the reason for this is because when you keep investing you will maximize the power of compound investing. My advice would be to invest either every month or every 2 weeks, it would also work to invest every week but then you need to be aware of the fees, so you don’t get charged more than you should.

When you form your portfolio based on the all-weather portfolio then you need to know your financial goals, this is because if your goals are to get a high return and you are young then you can do more risk and have the potential for even more reward. Or if you are around 50 years old then you can go for much more safer options and eliminate all risk, but it will probably be less profitable.

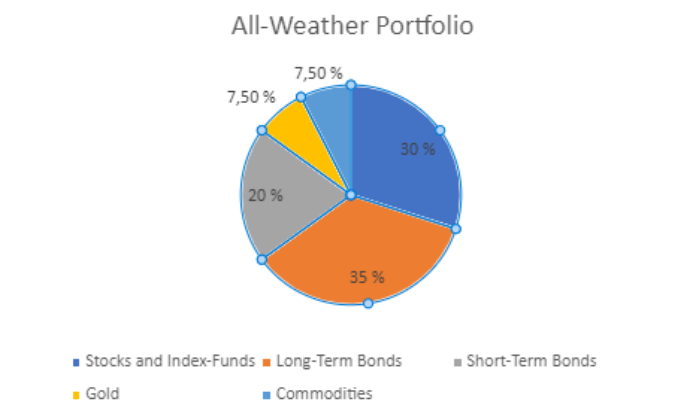

The all-weather portfolio: Example

Notice that the portfolio above is just an example, you can diversify between the categories to match your financial goals.

Long-term and short-term bonds.

Now, the first investment category we are going into today is Bonds, probably one of the safest options out there, but also profitable over time.

These types of investments are for people who simply want to put their money somewhere safe where it can compound

Now, what is a bond?

A bond is a debt security, similiar to an IOU. Borrowers issue bonds to raise money from investors willing to lend them money for a certain amount of time.

When you buy a bond, you are lending to the issuer, which may be a government, municipality, or corporation. In return, the issuer promises to pay you a specified rate of interest during the life of the bond and to repay the principal, also known as face value or par value of the bond, when it “matures,” or comes due after a set period of time. Bonds can provide a means of preserving capital and earning a predictable return. Bond investments provide steady streams of income from interest payments prior to maturity.

The interest from municipal bonds generally is exempt from federal income tax and also may be exempt from state and local taxes for residents in the states where the bond is issued.

There are many types of bonds, like treasury bonds, treasury securities, mortage backed securities, long term bonds, short term bonds, and so on.

But before you go invest in bonds, please do your research or talk to your financial adviser and find the best bonds to invest in for you.

Even though bonds are great investments, they can sometimes be to secure. And if you are looking to get a greater return than there are better options, but if you are looking at retirement or want somewhere to put your money where it can be safe and grow, than bonds and securities are great. But either way bonds and securities are investments everyone should have in their portfolio, for the more return hungry investors, you should look at this as a safety net for whenever there comes a market crash or recession.

Bonds are a big part of the weather portfolio. This is because it brings a type of security for whenever all the other markets are doing badly, even though bonds may look boring, they are powerful and have deserved their spot on the all-weather portfolio.

Stocks and index-funds

Even though my investing method is meant to eliminate risk and gain all the rewards, I do have a good portion of my portfolio in stocks and index funds. This is because personally I believe in businesses, especially those who are strong with a good future. But the way I invest in this category is by long term investing, the companies I invest in I will most likely hold for about 10-20 years.

(PS, a rule of thumb for long-term investors. You only sell if:

1. You need the money

2. The company Is going bankrupt

3. You find a better investment opportunity somewhere else.)

And you will eliminate very much risk when you invest for the long-term, because historically in the long run companies will grow. Because company’s number 1 goal is to grow, right. So, if you invest in the long run, you will overcome every bear market, recession or market crash, if the company or index fund you invest in is solid with huge potential of growth, like S&P 500 or companies like Apple, Microsoft, Facebook, JP Morgan, McDonalds, Coca Cola and so on. But before you go invest it is so important to do your research before investing, so do your homework.

But at the end of the day, you still will be exposed to some more risk in this category than the others. So, you might ask “Why do you have 50% if its riskier than the other categories?” well that is because 1) I am young, and that means I can take more risk for a bigger reward because I have many years to earn the money back if I lose money. 2) since I am young, I would rather take on more risk for a bigger reward, and then invest the rewards I make back into something more secure when I turn 30-40-50 years old.

The point is, the younger you are the more risk you can take.

The Diversification in index funds

-

US total stock index, Or Top 500 US (S&P-500)

-

Developed (foreign) Markets Index

-

US REIT Index (Real estate)

-

Long-Term US Treasuries Index

-

US TIPS Index (Treasury inflation-protected)

-

Emerging Markets Stock Index

When you invest in index funds it is vital that your funds have low fees, because in the long run the fees will eventually stack up and end up costing you profits you could have if you had a low-cost index fund.

The Diversification.

Basically, you want to be diversified over multiple markets, as I am diversified over stocks, real estate, treasuries, emerging markets and Developed markets.

And you don’t want to be all invested in one country, because then you put all your faith and investments into one basket which is not ideal, you would rather want to be diversified. I would recommend a low-cost index fund for the whole stock market (Not just the US, but the whole world.) One for emerging markets, and one for Developed markets (I would recommend EU, or Northern EU/Scandinavian index fund, for developed markets).

But again, before you go spend your money like crazy, DO YOUR REASERCH. Remember it’s not enough to trust some random investing guy on the internet, you must look up the facts, read through every document for every index fund you think of investing in. And if you’ve done your research and you are still unsure then seek a financial counselor at your local bank etc.

Commodities and Gold.

For the last category we have commodities. Now, commodities are raw materials or agricultural products. An example could be oil, silver, gold and so on.

The reason commodities are a part of this portfolio is because, commodities bring a kind of safety for whenever there is a market crisis, because commodities are products that we need to operate a normal society. Some of the other reasons why commodities are a part of this portfolio is because commodities offer a kind of diversification which is good, commodities give a hedge against inflation, investing in the right commodities can project a good return which is necessary for the all-weather portfolio and commodities gives a good diversification to the portfolio.

Now, the reason why gold itself takes up 7,5% of the portfolio is because gold gives a good hedge against inflation, gold can project good returns both in uncertain and certain market times. Gold is easy to buy and sell, and gold has high liquidity. Now, you don’t have to invest in gold in the form of buying physical gold, there are many ways to invest in gold. You can invest in gold by index-funds, ETF’s, Physical gold and so on. Just remember when investing in gold you should go for options that has low-cost and fees such as a low-cost index fund.

When you decide what kind of commodities and gold to invest in, you usually want to go for a low-cost index-fund that has a diversification spread over the whole commodity market, and you would want to invest in gold or a low-cost index-fund or ETF that track gold.

The Most important thing about investing with this portfolio, Diversification and asset allocation

Always refinance the portfolio at the end of the year or every 1.5 years, but not so much longer than that. What I mean by this is if for example if my stocks and index funds grow significantly, then at the end of the year I will sell of enough to even out the number again so every asset has the percentage of money that they shall have according to my portfolio diversification, (I will usually sell of at least over 1 year, for tax advantages.) Basically, I will sell of x if it has grown out of proportion and reinvest it into my portfolio again following how much percentage each asset should have.

The reason for this is because I want to stay diversified. Easily explained, if I invest 1 dollar into 5 different stocks, my portfolio will be diversified with 5 stocks, and 20% into each stock. But if one stock goes up to 2 dollars, then my portfolio wouldn’t be as diversified as before, it would instead be diversified over 5 stocks, but the one stock doesn’t hold 20% anymore, it holds now 30% of my portfolio. And the other stocks hold only 17,5% of my portfolio. So that is why I refinance my portfolio, to stay diversified through time.

The main point of the article is asset allocation and diversification, those two are the most important thing about investing…

Again before you leave, If you are looking for a book to educate yourself on Investing than I would suggest, The Intelligent Investor by Benjamin Graham. The reason I would suggest this book is because the book offers sound advice on investing from a trustworthy source – Benjamin Graham, an experienced investor who flourished after the financial crash of 1929. Having learned from his own mistakes, the author lays out exactly what it takes to become a successful investor in any environment.

Pingback: Elementor #2361 - sebastianjoergensen.com

Pingback: How To Invest Long Term, With Compound Interest - sebastianjoergensen.com

Pingback: Commodities, and the strength it will bring your portfolio - sebastianjoergensen.com

Pingback: Rare Metals Investing: Exploring potential benefits and risks

Pingback: Crude Oil Investing: Navigating The Opportunities & Risks In A Complex Market

Pingback: Top 6 ways to create a highly effective investing strategy - Valere Investing

Pingback: The Importance Of Asset Allocation - Valere Investing

Pingback: TOP 10 Mistakes To Avoid When Investing - Valere Investing